With shares traded on B3 – Brasil, Bolsa, Balcão (“B3”), the Brazilian stock exchange, ISA ENERGIA BRASIL is managed with the objective of generating value in a sustainable way, through the growth of the energy transmission business with efficiency and innovation.

Our common (ISAE3) and preferred (ISAE4) shares are listed on Level 1 of B3 governance, with the adoption of good practices and access to information by investors in addition to those required by legislation. Our majority shareholder is ISA, a multi-Latin company headquartered in Colombia and which exercises direct control.

The Company's subscribed and paid-in capital is R$3,590,020,000.00, divided into 658,833,304 shares, of which 257,937,732 are common shares and 400,945,572 are preferred shares.

The Company's corporate governance structure comprises the General Shareholders' Meeting, the Board of Directors, assisted by 3 non-statutory committees (Audit and Risks Committee, Organizational Talent Committee and Environmental, Sustainability, Governance, Technology, and innovation Committee (ESGTI), the Executive Board and the Fiscal Council.

ISA ENERGIA BRASIL's Board of Directors has an biannual mandate and is currently composed of 9 members, of which 2 are independent and 1 is a representative of the Company's employees.

The Fiscal Council operates permanently and is made up of 5 effective members and 5 alternates with a 1-year term of office.

The Board of Directors is made up of up to 5 (five) members, of Brazilian or foreign nationality, residing in Brazil, with a term of office of up to 3 (three) years, re-election being permitted, with one being the President Director, one (a) Executive Director of Operations, an Executive Director of Projects, an Executive Director of Regulatory and Strategy and an Executive Director of Finance, Investor Relations and Business Development.

The Board of Directors and Audit and Risk Committees, Organizational Talent and Corporate Governance, Sustainability, Technology and Innovation Committee (“ESGTI”) (“Advisory Committees”) annually conduct a formal self-assessment process of individual and collective performance. of the respective bodies.

The Board's assessment is based on measuring the performance of annual targets referenced in indicators, previously established by the Board of Directors, which support the Company's strategy, combined with the assessment of the adherence of each director's behavior to the Company's values.

The Fiscal Council does not have a mechanism for evaluating the performance of its members.

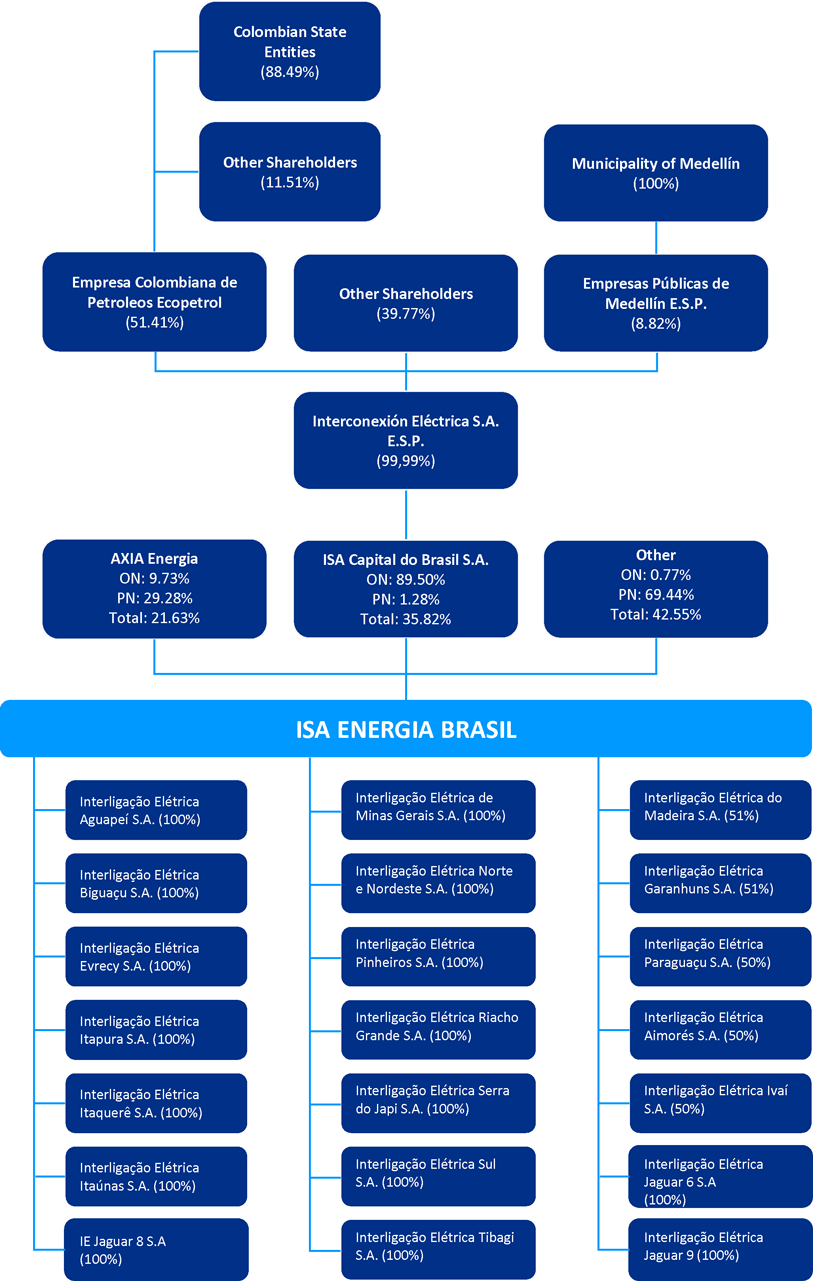

Ownership Breakdown

Controlled by ISA, a multi-latin linear infrastructure systems company, ISA ENERGIA BRASIL has among its investors Eletrobras, the largest Brazilian electric energy group. Of the Company's shares, around 58% are held by national investors and 42% belong to foreign investors.

| Shareholders | ISAE3 (common) | ISAE4 (preferred) | Total (common + preferred) | |||

|---|---|---|---|---|---|---|

| Shares | % | Shares | % | Shares | % | |

| ISA Capital do Brasil S.A | 230.856.832 | 89,50% | 5.144.528 | 1,28% | 236.001.360 | 35,82% |

| Management | - | - | - | - | - | - |

| Free Float | 27.080.900 | 10,50% | 395.801.044 | 98,72% | 422.881.944 | 64,18% |

| AXIA Energia | 25.106.829 | 9,73% | 117.399.836 | 29,28% | 142.506.665 | 21,63% |

| Others | 1.974.071 | 0,77% | 278.401.208 | 69,44% | 280.375.279 | 42,55% |

| Total | 257.937.732 | 100,00% | 400.945.572 | 100,00% | 658.883.304 | 100,00% |

Corporate Organization

ISA

With 43 affiliates and subsidiaries, ISA manages large scale infrastructure projects and contributes to the development of the countries in which it is present in, like Colombia, Brazil, Peru, Chile, Bolivia, Argentina and Central America. Its activities are concentrated in the sectors of transmission of electric energy, telecom and highway concessions.

In around 50 years of performance, the company has acquired as one of its main characteristics, its efficiency and reliability in the provision of services, with an emphasis regarding human rights and the environment. Its team exceeds 3.8 thousand high quality and committed employees.

ISA is positioned as one of the largest international electric energy transmission companies in Latin America with high voltage transmission systems, with 46.4 thousand km of transmission lines and 92.6 thousand MVA in transformation capacity in operation and 7.4 thousand km of transmission lines and 15.5 thousand MVA in transformation capacity.

To learn more about ISA, click here.

Updated on December 31, 2025.