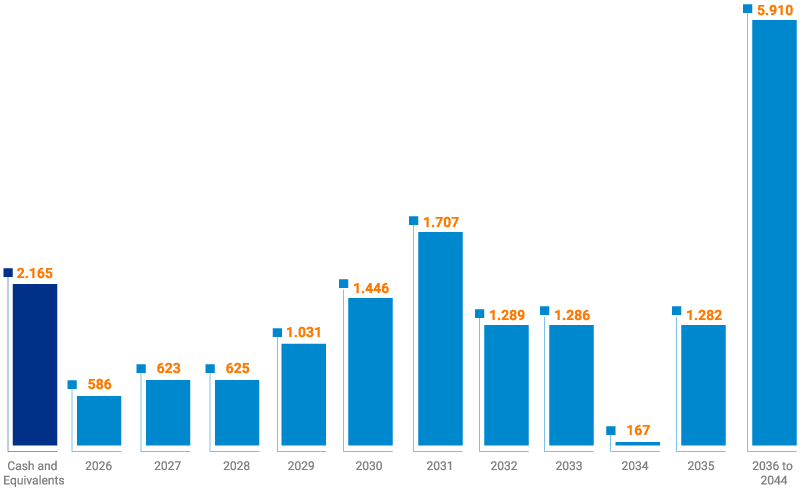

The Company’s gross debt reached R$ 16,007.3 million at the end of 4Q25, an increase of R$ 2,733.5 million (+20.6%) compared to the balance at the end of 4Q24. The Company also ended 4Q25 with total cash and cash equivalents of R$ 2,165.0 million (‑36.3% vs. December 31, 2024). Excluding cash and cash equivalents of jointly controlled companies, the Company’s net debt reached R$ 14,127.9 million as of December 31, 2025, an increase of R$ 3,898.1 million (+38.1% vs. December 31, 2024).

The increase was mainly due to debenture issuances carried out in 2025 totaling approximately R$ 4.0 billion, as well as the 4th BNDES disbursement, in the amount of R$ 82.1 million. The growth in indebtedness was partially offset by the settlement of the 7th debenture issuance (R$ 928.4 million) and by the optional early redemption of the 12th debenture issuance, totaling R$ 726 million. For further information, click here.

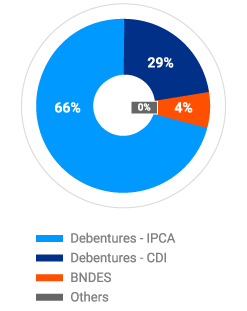

The increases of 265 bps in the annualized CDI (vs. 4Q24) and of 41 bps in the IPCA over the last 12 months led the Company’s average nominal cost of debt to reach 12.36% p.a. (vs. 11.83% p.a. in 4Q24). Considering the IPCA accumulated over the last 12 months, the average real cost of debt was 7.56%, an increase of 93 bps (vs. 6.63% in 4Q24).

The Company’s consolidated average debt maturity as of December 31, 2025 was 8.2 years (vs. 7.5 years as of December 31, 2024). The longer average maturity further strengthens the Company’s long‑term debt profile, which is consistent with the nature of its business, characterized by low risk and high predictability of revenues and operating cash flow—features highlighted by Fitch in assigning the Company a local‑scale ‘AAA’ corporate rating with a stable outlook.

Gross Debt Amortization Schedule

(BRL million)

Debt Contracting and

Indexing 12/31/2025

Debenture

| Issue | Category | Total offering | Nominal Unit Value | Series | Issue | Maturity | Remuneration | Documents |

|---|---|---|---|---|---|---|---|---|

| 8th Issue | Encouraged & Green Bond | BRL 409.0 million | BRL1 thousand | Single | 12/20/2019 | 12/15/2029 | IPCA + 3.50 per year |

|

| 9th Issue | 1ª série: Common 2ª série: Encouraged & Green Bond |

BRL1,600.0 million | BRL1 thousand | Two series | 12/7/2020 | 1st serie: 11/15/2028 2nd serie: 5/15/2044 |

1st Serie: CDI +2.83% p.a. 2nd Serie: IPCA + 5.30% p.a. |

|

| 10th Issue | Encouraged & Green Bond | BRL672.5 million | BRL1 thousand | Single | 2/10/2021 | 7/15/2044 | IPCA+5.07% p.a. |

|

| 11th Issue | Encouraged & Green Bond | BRL950 million | BRL1 thousand | Two Series | 10/28/2021 | 1st serie: 10/15/2031 2nd serie: 10/15/2039 |

1st Serie: IPCA + 5.77% p.a. 2nd Serie: IPCA + 5.86% p.a. |

|

| 13th Issue | Common | BRL550 million | BRL1 thousand | Single | 03/24/2023 | 03/15/2030 | CDI + 1.50% p.a |

|

| 14th Issue | Encouraged & Green Bond | BRL1,900.0 million | BRL1 thousand | Two Series | 10/25/2023 | 1st serie: 10/15/2033 2nd serie: 10/15/2038 |

1st Serie: IPCA + 6.26 p.a 2nd Serie: IPCA + 6.44% p.a |

|

| 15th Issue |

1st Serie: Common |

R$ 1,327 million | R$ 1 thousand | Three Series | 03/28/2023 |

1st Serie: 03/15/2029 |

1st Serie: CDI + 0.73% |

|

| 16th Issue | 1st Serie: Common | BRL1,000 million | R$ 1 thousand | Single | 05/29/2024 | 1st Serie: 05/20/2031 | CDI + 0.80% |

|

| 17th Issue | Encouraged & Green Bond | R$ 1,800 million | R$ 1 thousand | Two Series | 10/28/2024 |

1st Serie: 10/15/2036 |

1st Serie: IPCA + 6.71% 2nd Serie: IPCA + 6.60% |

|

| 18th Issue | Encouraged & Green Bound | BRL 1,400.0 million | BRL 1 thousand | Two Series | 03/26/2025 |

1st serie: 06/15/2033 |

IPCA + 7.41% a.a. IPCA + 7.41% a.a. |

|

| 19th Issue | Encouraged & Green Bond | R$ 580 million | R$ 1 thousand | Single | Up to 07/04/2025 |

06/15/2035 |

IPCA+6.70% a.a |

|

| 20th Issue | Encouraged & Green Bond | R$ 2,000 million | R$ 1 thousand | Two Series | 10/23/2025 | 1st Serie: 10/15/2037 2nd Serie: 10/15/2040 |

1st Serie: IPCA + 6.6598% a.a. 2nd Serie: IPCA + 6.6382% a.a. |

|

| 21st Issue | Common | R$ 3,854 million | R$ 1 thousand | Three Series | 02/12/2026 | 1st Serie: 01/15/2030 2nd Serie: 01/15/2031 3rd Serie: 01/15/2035 |

1st Serie: CDI+ 0.55% a.a. 2nd Serie: IPCA + 0.60% a.a. 3rd Serie: IPCA + 0.84% a.a. |

|

| Issue | Total offering | Nominal Unit Value | Series | Issue | Maturity | Remuneration | Documents |

|---|---|---|---|---|---|---|---|

| 2nd Issue | BRL 350 million | BRL 10 thousand | Single | 03/18/2013 | 03/18/2025 | IPCA + 5.5% per year |

|

| Issue | Total offering | Nominal Unit Value | Series | Issue | Maturity | Remuneration | Documents |

|---|---|---|---|---|---|---|---|

| 1st Issue | BRL 1.6 billion | 1.000 | Single | 12/15/2019 | 12/15/2043 (24 years) | IIPCA + 4.9982% per year |

|

| Issue | Category | Total offering | Nominal Unit Value |

Series | Issue | Maturity | Remuneration | Documents |

|---|---|---|---|---|---|---|---|---|

| 1st Issue | Institutional | BRL 250 million | 1 thousand | 1st Series 2nd Series |

06/26/2025 | 06/15/2030 06/15/2032 |

CDI + 0.50% p.y CDI + 0.59% p.y |

|

| Issue | Category | Total offering | Nominal Unit Value |

Series | Issue | Maturity | Remuneration | Documents |

|---|---|---|---|---|---|---|---|---|

| 1st Issue | Institutional | BRL 450 million | 1 thousand | 1st Series 2nd Series |

06/26/2025 | 06/15/2030 06/15/2032 |

CDI + 0.50% p.y. CDI + 0.59% p.y. |

|

Updated on February 24, 2026.